If I asked you "how many computing devices do you own?" your mind will probably first jump to your PCs and laptops at home, and then to your smartphones and tablets. The more tech savvy might include smartwatches, TVs, and video game systems. But there's one computing device that not many people think about as a computing device: the car infotainment system.

Like everything else, infotainment systems are computers with processors, operating systems, and applications, but you won't find much material out there that treats them as such. Microsoft, Apple, Google, Samsung, and others hold big press conferences about their new hardware and software, touting ever-larger spec sheets, new features, and universally known sub-brands like iPhone, Surface, and Galaxy.

But you'll almost never see car companies announce how much RAM is in their new car infotainment systems, though; most won't speak a word about specs or even say what software they're running. Sure, the main purpose of a car is to drive it, so horsepower, safety, and comfort are top-of-mind. But after the steering wheel, pedals, and (for some drivers) the turn signal, the infotainment system is one of the most-used interfaces of a car. If it sucks, you're probably going to be unhappy.

So today we're going to treat car computers like every other kind of computer and see how car companies are adapting to the age of the smartphone. Consumers are demanding ever-more-complicated tech packages in their cars, and some members of the 100-year-old car industry are adapting to it better than others.

Welcome to the infotainment Wild West

In the early days of the PC, there were lots of operating systems—DOS, Mac OS, OS/2, Windows, BeOS, AmigaOS, and others. Eventually, the platform matured, and things settled out to (mostly) a duopoly of OSes—Microsoft's Windows and Apple's macOS. In the early days of smartphones, there were lots of operating systems—Palm OS, Windows Mobile, Symbian, BlackBerry OS, Brew, and others. Eventually, the platform matured, and things settled out to (mostly) a duopoly of OSes—Google's Android and Apple's iOS. It is with this in mind that we look at the current state of the car computer, where we definitely seem to be in the "early" days.

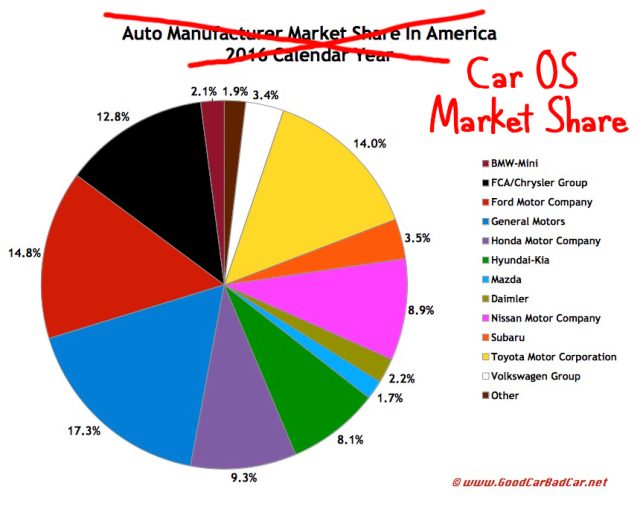

Today, there is no shortage of car OSes, all of which are heavily customized by and exclusive to each car manufacturer. For general underlying operating systems, we've got Blackberry's QNX, Microsoft's Windows Embedded Automotive, plenty of custom Linux-based OSes, and plenty of custom Android Open Source Project (AOSP)-based OSes, which itself is Linux-based. Car companies usually build custom interfaces on top of these OSes and brand them as productions of the car company, with names like "Ford Sync" and "Audi MMI."

Of the "big three" consumer operating system companies—Microsoft, Google, and Apple—only Microsoft currently competes in the automotive OS market. Apple and Google both have "projected" car interfaces—CarPlay and Android Auto, respectively. But these are merely run from a smartphone and are sent to the car display. They are not real operating systems and essentially run as apps on top of one of the previously named car OSes. There's also the similar "MirrorLink" system, which—with a compatible car and phone—will send your entire phone display to the car screen.

Microsoft has had a car platform seemingly forever, starting with the (aftermarket) Windows CE 2.0-based "Auto PC" in 1998. Microsoft's car platform (which, in typical Microsoft fashion, has changed names about five times over the years) had a serious foothold in the market with Ford Sync. But after Ford switched to Blackberry's QNX, many wondered if Microsoft has a future in the infotainment market. The company recently signed a deal with Renault-Nissan, but it's too early for any real products yet.

Several cars today run Google's operating system, Android, but everything you see out there is an AOSP (Android Open Source Project) derivative created without Google's involvement. While the Google-less Android distributions proliferate, Google is working on copying its smartphone strategy over to the automotive market. Google's "Open Handset Alliance" is a group of smartphone OEMs that have committed themselves to using Google-blessed Android distributions. The car-focused version of this group, the "Open Automotive Alliance" already counts 50 car brands (heavily inflated from badge engineering) as members. These members sign contracts promising to follow Google's Android compatibility requirements, and we've already seen car-specific language (see: "Android Automotive") start to pop up in Google's compatibility docs.At trade shows, Google has shown off two separate Android car OS concepts: one with a Google-designed interface, which would be similar to a "Pure Google" Pixel phone, and one that has been skinned with a custom interface from Fiat-Chrysler, which is similar to what Android smartphone partners like Samsung and LG do. The whole concept is an exact copy of Google's smartphone strategy. But how many car manufacturers will look at the smartphone market and be willing to actually ship a Google car OS?

As for Apple—if the company follows its usual strategy of vertical hardware and software integration, it would only produce a car OS if it also produced a car. As farfetched as that may seem, rumors claim Apple has had an autonomous electric car project in the works since 2014 called "Project Titan." According to The New York Times, the 1,000-person-strong Project Titan team has undergone a "reboot" recently, which involved some layoffs. Apparently the group is pivoting away from designing a car and more toward "building out the underlying technology for an autonomous vehicle." So CarPlay seems like it will be the company's in-car solution for the foreseeable future.

With the big consumer software vendors on the sidelines, we have a situation that looks a lot like the pre-iOS/pre-Android days. Every automaker is building a car OS that is incompatible with every other car OS, so "Car OS app stores" are not really a thing. The market is a nightmare for app developers, and, at best in a car, you'll get a single-digit lineup of packed-in apps—and that's it.

For a look at what wide car support in 2017 looks like, check out Pandora's insane "How to listen to Pandora in the car" support page, which lists all of its disparate pack-in clients. Between car manufacturers and aftermarket stereos, Pandora lists 33 different brands that have the Pandora app. Some of those car brands are owned by a single company and share an infotainment platform, and Pandora can probably share some code across certain versions. But the company is still looking at something like 20 clients that are all somehow different.

A big reason any OS market usually coalesces from many operating systems to a small handful of options is because of app developers. Before the Android/iOS duopoly in smartphones, Google CEO Larry Page once complained his company had "a closet full of over 100 phones" just to maintain the Google mobile apps, and the company was "building our software pretty much one device at a time." With the car infotainment market in pretty much the same state today, Pandora must need a garage full of cars to maintain its car app. For most third-party developers, duplicating Pandora's herculean car app development efforts is financially impossible. So apps just don't get made.

The other problem with car computers is age. Designing a car computer is much more complex than building a desktop, laptop, or smartphone. The biggest problem—one that you'll need to consider over and over again when you see the choices that car manufacturers make—is that designing and releasing a car takes about three to five years. This means that every computing component is going to be a bit old, and no one has figured out how to put cutting-edge computing parts into a car. Meanwhile, the need to comply with safety regulations from government groups all around the world is a lengthy process that contributes to the pokey rollout of technology.

Keep in mind that, while history shows the original iPhone kicking off the modern touchscreen smartphone revolution 10 years ago, it was initially met with lots of skepticism. So in addition to the three- to five-year turnaround time, you also have to factor in when each individual car manufacturer realized iPhone-style smartphones were the future. As a result, most car companies are only on their second-generation interface.

With the basics set up, let's take a look at some of the individual car infotainment systems that are out there.

reader comments

196